CEO tells Investing.com about strategy, growth plans

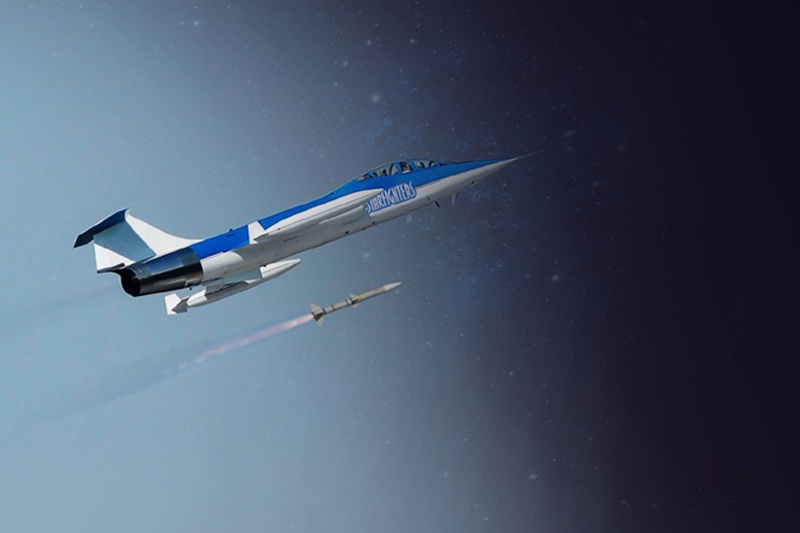

Investing.com — Shares of Starfighters Space, a Kennedy Space Center company that operates a fleet of commercially flight-ready MACH2 supersonic aircraft, are set to begin trading on the NYSE American, an exchange for small- and mid-cap high-growth companies, on Thursday under the ticker FJET.

In an exclusive interview with Investing.com, Rick Svetkoff, CEO and Founder of Starfighters and former U.S. Navy pilot, shares with investors some of the recent developments at the company leading to the IPO. More precisely, Svetkoff discusses what investors can expect as the company enters its next stage of expanding capabilities.

The listing follows the company’s IPO to raise $40 million and is the first instance of a space company using the Regulation A route to an IPO. Regulation A provides smaller companies access to public capital markets through a less extensive process than a registered offering.

Starfighters’ listing comes amid heightened investor interest in space/defense technologies as Trump 2.0 and other geopolitical developments are seen as supportive for the sector. As governments ramp up space exploration programs as well as defense spending, companies across the spectrum expect to benefit from growing demand.

Tell us a little about Starfighters and why it is going public. Why now? And what went into the decision to go from Regulation A to an IPO?

Rick Svetkoff: Starfighters is an aerospace company focused on providing faster, more flexible access for space, defense, and advanced aerospace missions using flight-ready supersonic aircraft. We’re an operating company with real assets, real missions, and a long history of aviation execution.

Going public is a natural next step. Regulation A allowed us to build the business, validate demand, and broaden our investor base early. Moving from Regulation A to a traditional IPO reflects increased maturity, governance, and scale, and positions us to access larger pools of capital as opportunities expand.

The timing reflects a convergence: growing government and commercial demand, renewed focus on space and defense readiness, and increased investor interest in companies with tangible capabilities rather than long-dated concepts.

To what extent will capital raised from the IPO be directed toward advancing opportunities within the MACH-TB program? And what are the biggest technical or regulatory risks that could alter your 2026 revenue targets?

Rick Svetkoff: The proceeds are intended to support fleet expansion, infrastructure, and the development of new mission capabilities, including participation in programs like MACH-TB.

MACH-TB (Multi-Service Advanced Capability Hypersonics Test Bed) is a U.S. Department of Defense program designed to provide faster, lower-cost flight testing for hypersonic technologies by using modular systems and commercial launch capabilities.

As with any advanced aerospace or defense-related work, timelines are influenced by technical validation, testing requirements, and regulatory approvals. That includes aviation certification, launch waivers, and program-specific milestones. These are well understood risks in our sector and are outlined in our public filings.

We’ve structured the company to remain disciplined and flexible, continuing to generate revenue from existing services while developing new capabilities in parallel.

What do investors need to know about the space technologies developed and employed at Starfighters and their potential across sectors/defense?

Rick Svetkoff: Starfighters’ value lies in how we operate, not just what we’re developing. Our platform enables rapid testing, training, and space-adjacent missions that benefit defense, research institutions, and commercial partners.

The same capabilities that support space access also apply to hypersonic testing, advanced aerospace R&D, and national security applications. This multi-use potential allows us to serve a broad customer base rather than relying on a single market or program.

For investors, that diversification matters: it reduces dependency on any one outcome while preserving upside as new applications mature.

Investors should understand that not all space companies are competing for the same missions. Starfighters is focused on the smaller-payload, high-speed, high-altitude segment, where flexibility and rapid access matter most.

Traditional launch providers are optimized for large, scheduled missions, while Starfighters provides a more responsive, on-demand platform for testing, evaluation, and future launch applications. This complementary positioning allows Starfighters to address missions that existing systems do not serve efficiently.

What expansion plans does the company have over the near to medium term? And what can investors expect in terms of earnings growth, given the company’s significant R&D plans? What does near- and long-term revenue visibility look like?

Rick Svetkoff: Near-term, the focus is on scaling operations, expanding fleet availability, increasing mission cadence, and adding talent and infrastructure where demand supports it. Medium-term, we aim to broaden the mix of services we offer, including advanced testing and space-access capabilities.

As an R&D-intensive company, we expect continued investment before profitability. That said, Starfighters has historically generated revenue from operational services and intends to build on that foundation as new capabilities come online.

As a public company, investors will gain visibility into revenue, expenses, and progress through regular SEC reporting.

What are your expectations from the MACH-TB program? Can you discuss any partnerships and sub-contracts, and what this might mean for the company going forward?

Rick Svetkoff: MACH-TB (Multi-Service Advanced Capability Hypersonic Test Bed) is a U.S. Department of Defense program that uses commercial rockets and reusable test vehicles, such as Starfighters’ F-104 fleet, to rapidly and affordably test new hypersonic technologies (speeds > Mach 5) for advanced weapons and defense systems, overcoming previous slow, expensive test infrastructure limitations by leveraging private sector innovation for frequent flights.

Because Starfighters is aircraft-based and uses the F-104 as a test platform “wind tunnel in the sky,” makes it ideal for the MACH TB program. Kratos Defense and Security Solutions was awarded the prime contract, and Starfighters is a subcontractor to Kratos.

For investors, the key takeaway is that these programs can serve as both a revenue opportunity and a credibility accelerator, but we approach them with disciplined expectations rather than assuming any single program defines the company’s future.

Source: LINK